Dive Brief:

- A broad coalition of stakeholders have joined to fight for an extension of the federal tax credit on electric vehicles (EV), and officials at the newly-launched EV Drive Coalition say they are "laser focused" on getting this accomplished in the lame duck Congressional session.

- A $7,500 tax credit goes directly to the consumer, helping lower the price on the first 200,000 EVs sold by a manufacturer. But as Tesla crests that figure and other companies come close, the group says the credit needs to be extended to continue giving a boost to the industry.

- EV proponents say there is support on both sides of the aisle for extending the tax credit, but it is not unanimous. The new coalition is also focused on defeating legislation proposed by Senator John Barrasso, R-WY, to eliminate the credit altogether.

Dive Insight:

Electric vehicle adoption is coming — and soon, say many in the industry — but car manufacturers and other stakeholders believe the federal tax credit is necessary to narrow price differences between the emissions-free vehicles and internal-combustion counterparts.

EV Drive Coalition includes GM, Tesla, Nissan, ChargePoint, Plug in America and several others. A spokesman for the group says that while charging infrastructure will be vital to the long-term success of electric vehicles, right now there is still more support needed for the purchase of cars.

"Lifting the cap would create a more level playing field for all manufacturers," Joel Levin, executive director of Plug In America, said in a statement. "Arbitrary constraints with the federal credit limit consumer options and make it harder for consumers to purchase the cars they want."

At the moment, there are less than 1 million EVs on the roads in the United States. But a major shift is expected. Bloomberg New Energy Finance predicts EVs will represent 28% of global light-duty vehicle sales sometime shortly after 2025. And the Edison Electric Institute estimates 7 million zero-emissions vehicles will be on U.S. roads by 2025.

For some, that means the federal tax credit is unnecessary. The legislation proposed last month by Barrasso, chairman of the Senate Committee on Environment and Public Works, would end the federal EV tax credit and impose a federal highway user fee on alternative fuel vehicles.

The EV credit "largely benefits the wealthiest Americans and costs taxpayers billions of dollars," said Barrasso in a statement.

There have been some proposed tweaks to the credit to make it more competitive, which include pooling the funds for all manufacturers to access, adding a vehicle range requirement and a price cap.

But the first order of business, according to EV Drive Coalition spokesman Trevor Francis, is to defeat Barrasso's legislation.

"We are laser-focused," Francis told Utility Dive. "We're trying to resolve this question as soon as we can and we see the lame duck session as the perfect opportunity."

Francis said there is legislation in the works in the House and Senate to extend the credit, and he said there is bipartisan support for the idea — though at this point, there are no bipartisan bills.

"We're looking for temporary reform," Francis said. "There will come a time when the market is self-sustaining. ... but it is critically important to take care of this now, to provide certainty to the market and to reform the helpful but somewhat-flawed credit."

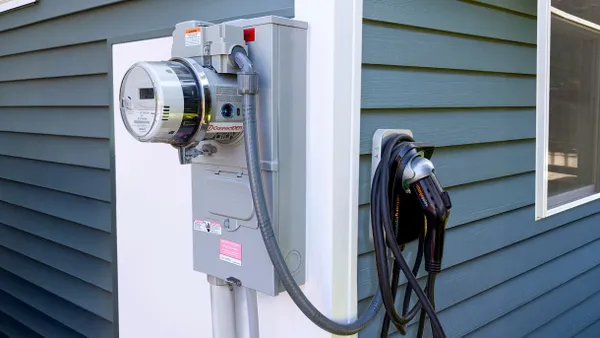

Francis also said that while infrastructure to support EVs — like charging stations — is necessary, right now the purchase credit is more vital. Charging station developers are a part of the coalition, he pointed out, but said "EV infrastructure is completely dependent on having EVs on the road."

By 2025, some analysts estimate there will be 6 million residential charging locations in the United States. By comparison, there are about 170,000 gas stations in the United States.